About

Our process

ABOUT

Our process

Our formula details everything you need for enduring, successful wealth management, both now and into the future.

To us, the ideal wealth management system is as follows:

Wealth Management

Investment Consulting

We manage each element in your portfolio, to maximise the probability of achieving the goals most important to you. This includes portfolio performance analysis, risk evaluation, asset allocation, cost and tax impact assessment, and investment policy review.

Advance planning

Advanced planning goes beyond investments. We’ll help you:

- Enhance your wealth through maximising your cash flows and minimising your tax liability;

- Safely disperse your assets and capital to the next generation;

- Identify any personal and financial risks to protect your long-term goals; and

- Ensure that your personal passions, like any charitable giving, remains intact, and even becomes tax-effective.

Relationship Management

A key factor in successful family wealth transitions is good communication between family members — so we help you keep your communication lines open. As the custodians of your wealth management system we manage the relationships between everyone involved in maintaining your wealth. This includes family members, clients, and our network of professional independent advisors.

Wealth Management

Investment Consulting

We manage each element in your portfolio, to maximise the probability of achieving the goals most important to you. This includes portfolio performance analysis, risk evaluation, asset allocation, cost and tax impact assessment, and investment policy review.

Advance planning

Advanced planning goes beyond investments. We’ll help you:

- Enhance your wealth through maximising your cash flows and minimising your tax liability;

- Safely disperse your assets and capital to the next generation;

- Identify any personal and financial risks to protect your long-term goals; and

- Ensure that your personal passions, like any charitable giving, remains intact, and even becomes tax-effective.

Relationship Management

A key factor in successful family wealth transitions is good communication between family members — so we help you keep your communication lines open. As the custodians of your wealth management system we manage the relationships between everyone involved in maintaining your wealth. This includes family members, clients, and our network of professional independent advisors.

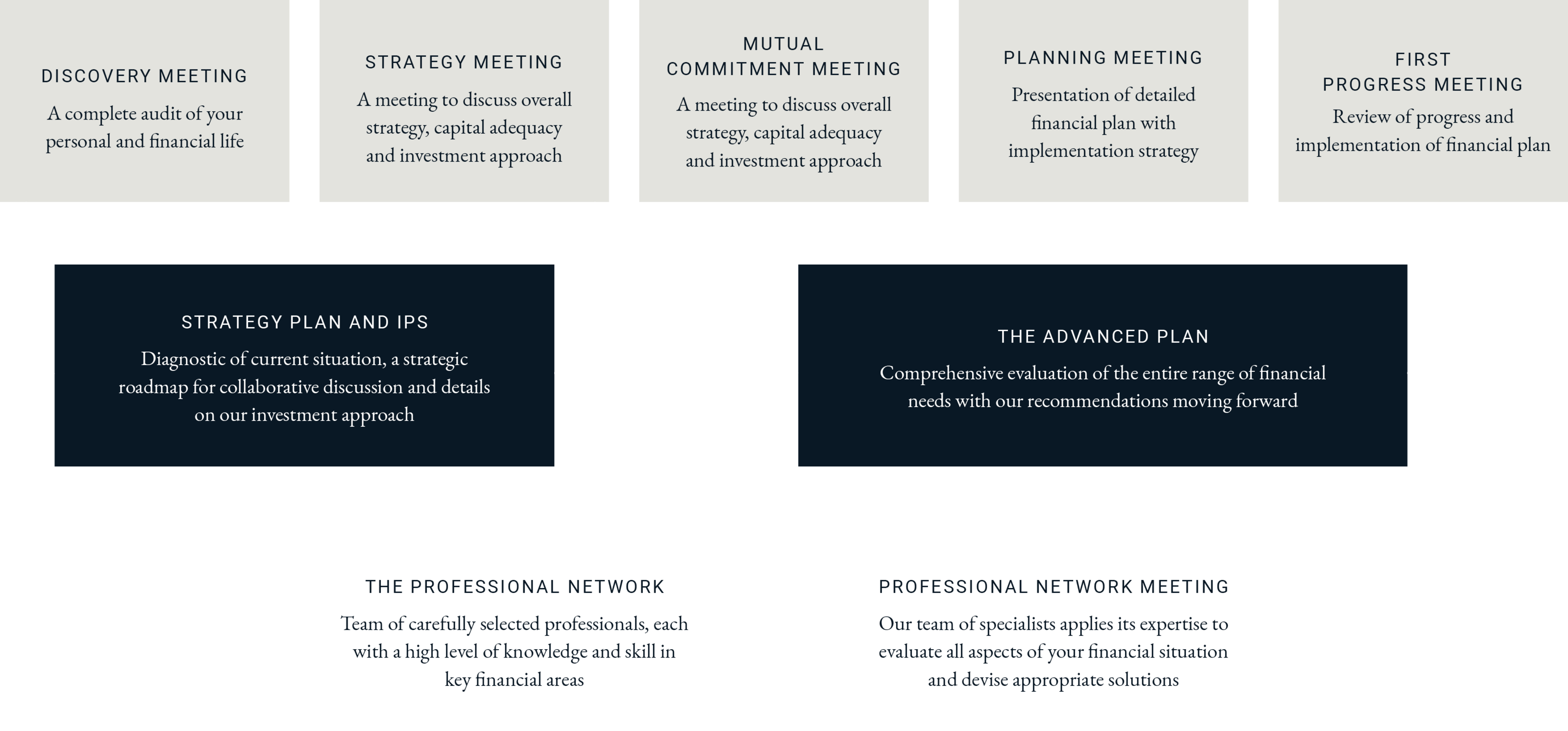

Our wealth management partnership process

Here’s a chart that outlines succinctly how we’ll work together to manage your wealth.

PODCAST

Whether you have significant financial resources and question the meaning of success, or you’re wondering whether being that little bit wealthier will make you happier, this is the podcast for you. The It’s Never About Money site is also a hub for money related blogs and education.

Whether you have significant financial resources and question the meaning of success, or you’re wondering whether being that little bit wealthier will make you happier, this is the podcast for you. The It’s Never About Money site is also a hub for money related blogs and education.

Joe & James’ professional practice is to be admired. They are always there for his clients when needed. They freely pass on their expert knowledge without hard product selling techniques

DR. ELSPETH MCKAY

Professor

Clear, timely and direct responses in all areas of communications are outstanding. Meetings are planned and run efficiently to deliver on all our expectations. The firm’s values align to our own so that trust is readily established.

MR JOHN AND DR KIM WATTY

Self funded retirees

Joe & James’ professional practice is to be admired. They are always there for his clients when needed. They freely pass on their expert knowledge without hard product selling techniques

DR. ELSPETH MCKAY

Professor

Clear, timely and direct responses in all areas of communications are outstanding. Meetings are planned and run efficiently to deliver on all our expectations. The firm’s values align to our own so that trust is readily established.

MR JOHN AND DR KIM WATTY

Self funded retirees